Imagine you get a chance to buy a coffee shop. Here is what the owner tells you.

The current sales = $ 74,000 /yr

Shop rent = $30,000 /yr

Employee salary = $25,000 /yr

Coffee beans = $15,000 /yr

The cost of furniture and coffee machine = $45,000

How much are you willing to pay?

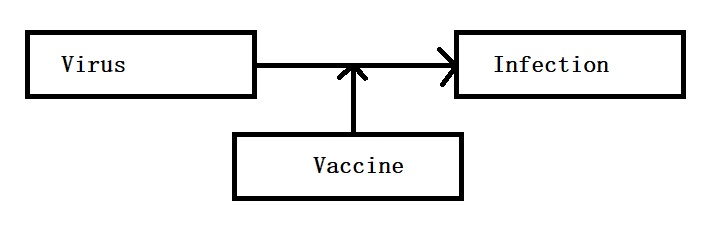

Market value

A simple valuation shows the shop can generate $4,000 a year (74,000 – 30,000 – 25,000 – 15,000) after paying for the rent, salaries and the purchase of the coffee beans. If you feel the shop will generate the same forever, you can do a simple (perpetuity) formula of 4000 / 0.1 = 40,000; 0.1 represents the discount rate of 10%. So you are willing to pay a maximum of $40,000.

The owner reminds you that she spent 45,000 just a few weeks ago to renovate. Will you change your mind? Sadly, it shouldn’t. The cost the owner sunk in the past can’t change the value it generates in the future. The buyer politely replies that she could get $500 more ($4,500) every year if she invested that 45,000 in the market at a 10% return. So what the owner spent (the book value) is immaterial to the buyer who calculated the market value.

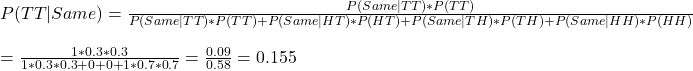

Movie or football

Mat bought a ticket for a movie by paying $25. Just before he starts, he gets a phone call from John, who invites him to watch a football match. Mat likes football and John’s company, yet declines the invite because he has already spent the ticket price of the movie.

The money Mat spent is sunk, and what matters now is what gives him a good time (movie vs football with friends). But Mat falls for the sunk cost fallacy, the bad feeling for the loss on things that have already been spent against a better return in the future.

The concord of failures

The fallacy of sunk cost is common in big projects. Companies often hesitate to shut down projects midway when even they realise that it’s getting expensive and the product won’t make any economic benefit. They rationalise they invested too much to quit.

Social scientists hypothesise three reasons for this fallacy

- The loss aversion

- Desire not to appear wasteful

- To force one to do things that otherwise won’t happen

Psychology of decision making

The sunk cost fallacy is a powerful force that impacts decision-making. The issue with sunk costs is that they are the things of the past, but we pay too much attention to them. It’s the same feeling that keeps you attending the whole show of a terrible movie, eating everything ordered even when you are full, or continuing a nonfunctional relationship solely because the couple spent four years of their life together.

Reference

Sunk Costs: The Big Misconception About Most Investments: Sprouts