Monthly Miracle

“During the time that we are awake and actively engaged in living our lives, roughly for eight hour each day, we see and hear things happening at a rate of about one per second. So the total number of events that happen to us is about thirty thousand per day, or about a million per month. With few exceptions, these events are not miracles because they are insignificant. The chance of a miracle is about one per million events. Therefore we should expect about one miracle to happen, on the average, every month”

Freeman Dyson

Morgan Housel’s latest book, Same as Ever’, continues from where he left off in his earlier very popular, “The Psychology of Money”. It’s about human psychology and its inability to comprehend probability.

The brain always craves certainty or a black-or-white world. And even trained people find it challenging to reconcile with the math behind chances. The lottery winning odds, as perceived by journalists in the last post, is just one example of that. The result is that newspapers continue to display shocking headlines, reinforcing people’s trust in magic and divine interventions.

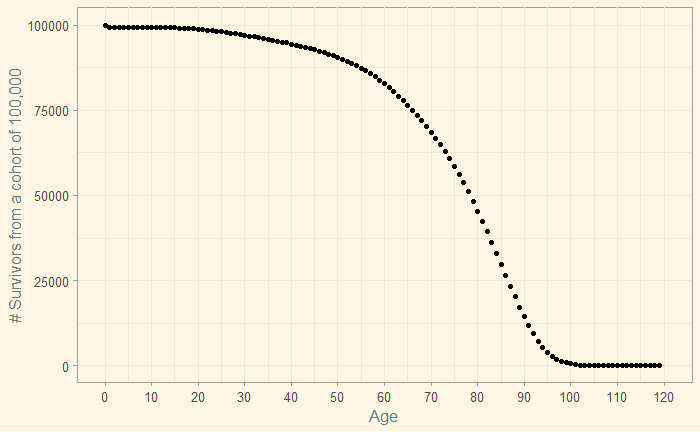

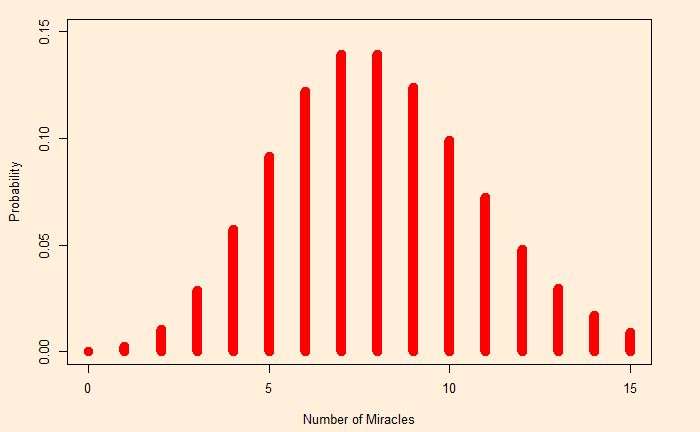

Here is an example: in a world with 8 billion humans, how many rarest of rare events, i.e., something with a probability of occurrence of once in a billion in a year, happens in a year? It seems difficult to imagine 8 billion people interacting with their surroundings is analogous to 8 billion independent binomial trials:

P(s; p, n) = nCs x ps (1-p)n-s

The formula represents the probability of s number of ‘success’ if n number of independent trials happen, each with a chance of p. In our problem, substitute n with 8 billion and p with 1/1,000,000,000.

The probability of no ‘miracle’ happening in a year, i.e., s = 0.

P(0; 1×10-9, 8×109) = 1 x 1 x (1-1×10-9)8e9

The answer is almost ZERO; subtracting 10-9 from 1 gives a fraction just short of 1, which multiplies by itself a few billion times, and the answer leads to nearly nothing.

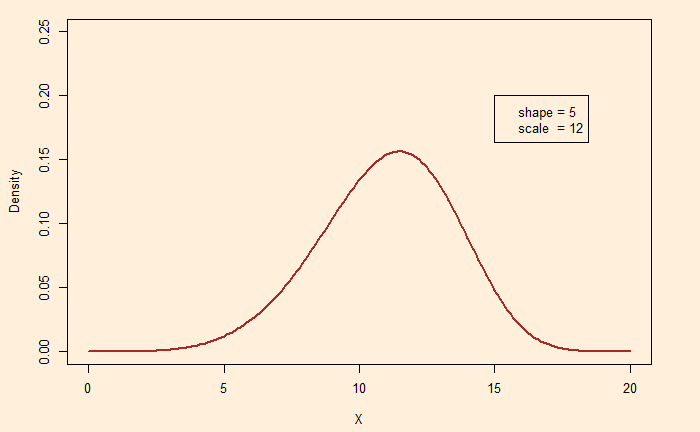

You can evaluate the formula for s = 1, 2, etc. We will use the R function for that and plot.

s <- seq(0,15)

plot(s, dbinom(s, 8e9, 1e-9))

There is more than a 10% chance to see 5, 6, 7, 8, 9 or 10 miracles in a given year. The only thing is: it can’t say where it will happen; it will happen somewhere, and the journalist will dig it up to her headlines.