Properties of Risk

Howard Marks continues with his memos for his clients by explaining a few properties of risk. According to him:

Risk is counterintuitive

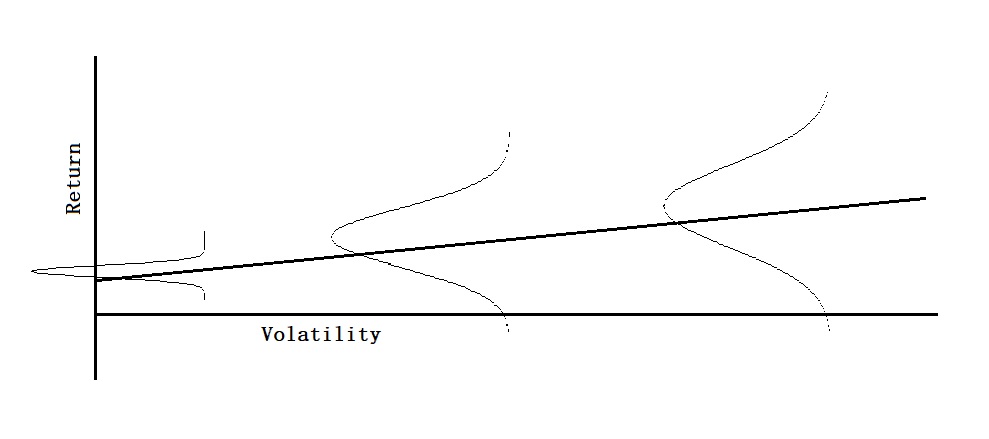

- The riskiest thing in the world is the belief that there is no risk. As per Nassim Taleb, the way many investors view the market is often worse than Russian Roulette. In Roulette, there is one bullet in one of the six chambers of the revolver. But in investing, the frequency of bad events is so scarce (many chambers) that people start believing that there is no bullet inside.

- Good awareness that the market is risky improves the investors’ due diligence, making it less risky.

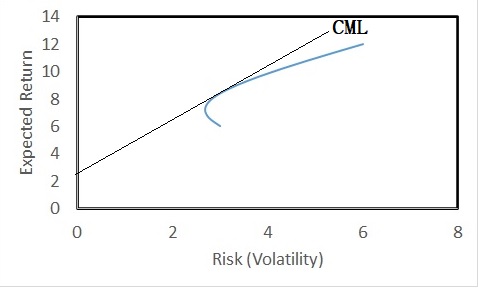

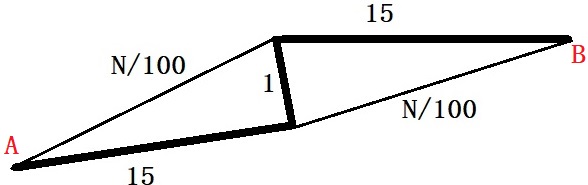

- When the asset price declines, people think it becomes riskier to invest, but it actually becomes safer. The opposite is also true; when the price increases, people are attracted to it as a safe instrument, forgetting the asset has actually become riskier.

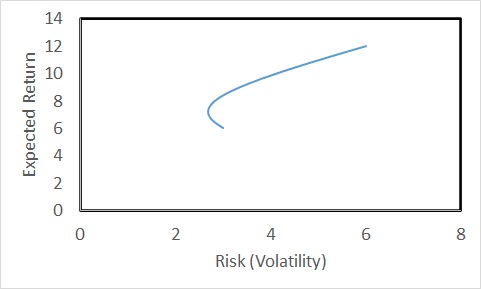

- Having only safe assets of one type (lack of diversification) can make the portfolio vulnerable. On the contrary, having a few riskier but different types can make the portfolio more diversified and less vulnerable.

Risk aversion makes markets safer

As seen above, a risk-conscious investor does proper due diligence on the market, makes conservative assumptions, and demands a higher premium for the risk.

Risk is invisible

Most of the knowledge of risk comes from hindsight, i.e., after the event has happened.

Risk control is not risk avoidance

While proper control is necessary, avoiding the risk altogether prevents the investor from reaching her goals.

Reference

Howard Mark’s Memo: Risk Revisited

Properties of Risk Read More »