What’s Wrong With Coffee?

Conflicting reports on the health benefits of drinking coffee is a topic of debate and confusion, often made science and scientists subjects of jokes. Over the years, several researchers have tried to establish associations between consuming coffee and a bunch of outcomes such as hypertension, cancer, gastrointestinal diseases – you name it.

Why these discrepancies?

Many of these studies are observational and not interventional. To make the distinction, cohort studies are observational, whereas randomised controlled trials (RCTs) are interventional. Establishing causations from observational studies is problematic.

In addition, coffee contains over 2000 active components, and theorising their impact on physiology, with all possible synergistic and antagonistic effects, is next to impossible. See these observations: taking caffeine as a tablet causes four times the elevation of blood pressure compared to drinking caffeinated coffee. There is an association of elevated BP with caffeinated drinks but none with coffee. So, accept this is complex.

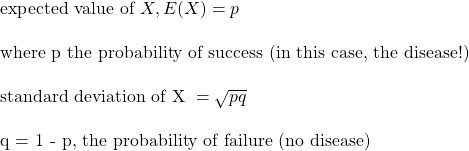

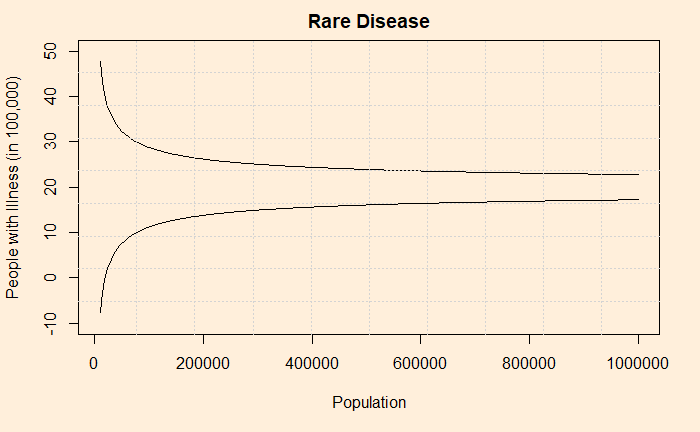

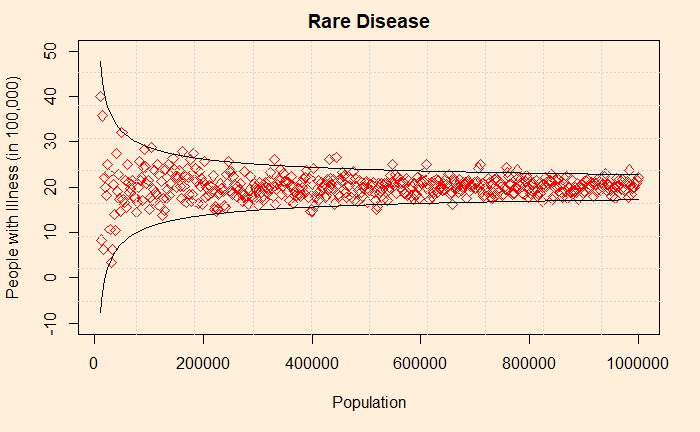

Jumping to a conclusion is another issue. Researchers are often under tremendous pressure to publish. And like journalists, they too get carried away by results with sensation content. As a result, the authors (and readers) advertise relative risks as absolute risks, forget confidence intervals, shun the law of large numbers (or the absence of the law of small numbers) or ignore confounding factors!

Confounders

How will you respond when you hear a study in the UK that found an association between coffee drinking and elevated BP? First, who are those coffee drinkers in the land traditionally of tea lovers? If it was the cosmopolitan crowd, are there lifestyle factors that can have a confounding effect on the outcome of the study: working late hours, lack of exercise, higher stress levels, skipping regular meals, smoking?

The same goes for the beneficial effect of coffee on Parkinson’s disease. What if I argue that people with a tendency to develop the disease are less interested in developing such addictions due to the presence or absence of certain life chemicals? In that case, it is not the coffee that reduced Parkinson’s, but a third factor that controlled both.

Absolute or Relative

The risk of lymphoma is 1.29 for coffee drinkers, with a confidence interval ranging from 0.92 to 1.8. What does that mean? 30% of people who drink coffee get lymphoma? Or a relative risk with a wide enough interval that enclosed one inside it? If it is a relative risk, what is the baseline incident rate of lymphoma? More questions than answers.

Meta-analysis

Meta-analysis is a statistical technique that combines data from several already published studies to derive meaning. A meta-analysis, if done correctly, can bring the big picture from the multitudes of individual findings. The BMJ publication in 2017 is one such effort. They collected more than 140 articles published on coffee and its associated effects that provided them with more than 200 meta-analyses, including results from a few randomised controlled studies.

The outcome of the study

- Overall, coffee consumption seems to suggest more benefits than harm!

- 4% (relative risk)[0.85-0.96] reduction in all-cause mortality.

- A relative risk reduction of 19% [0.72-0.90] for cardiovascular diseases.

- Same story for several types of cancers, except for lung cancer. But then, the association of a higher tendency for lung cancer was reduced when adjusted for smoking. For non-smokers, on the other hand, there is a bit of benefit, like in the case of other cancers.

- Consumption of coffee leads to lower risks for liver and gastrointestinal outcomes—similar association for renal, metabolic, and neurological diseases such as Parkinson’s.

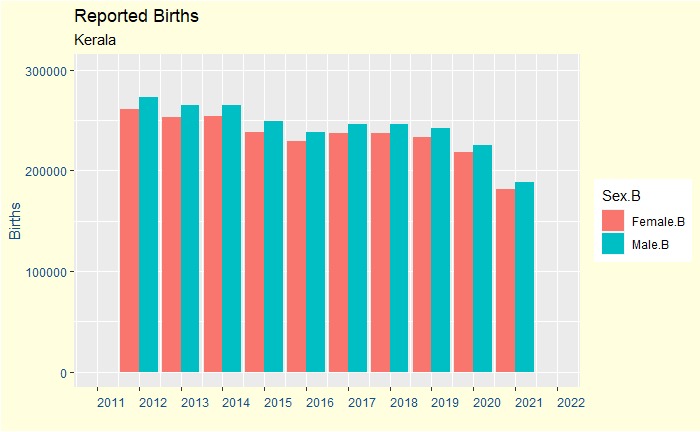

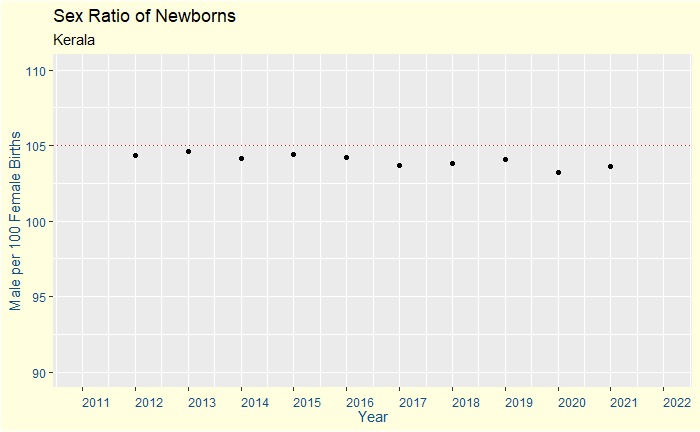

- Finally, something bad: harmful associations are seen for pregnancy, including low birth weight, pregnancy loss, and preterm birth.

- Many of these associations are marginal, and also the domination of observational data reduces the overall quality of conclusions. These results would benefit from more randomised controlled trials before formalising.

Meta-Analysis: NCBI

Randomised Controlled Trials: BMJ

Confounders contributing to the reported associations of coffee or caffeine with disease: NCBI

Coffee consumption and health: BMJ

Coffee and Health: Nature

What’s Wrong With Coffee? Read More »