Pilot Hit

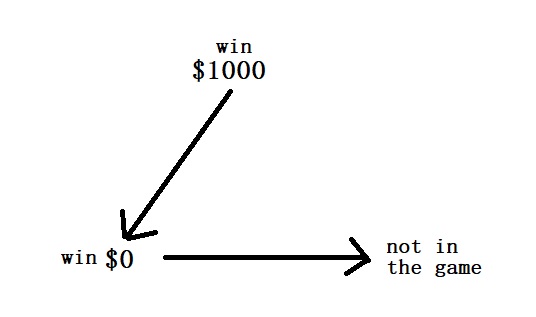

Data from a television production company suggests that 10% of their shows are blockbuster hits, 15% are moderate success, 50% do break even, and 25% lose money. Production managers select new shows based on how they fare in pilot episodes. The company has seen 95% of the blockbusters, 70% of moderate, 60% of breakeven and 20% of losers receive positive feedback.

Given the background,

1) How likely is a new pilot to get positive feedback?

2) What is the probability that a new series will be a blockbuster if the pilot gets positive feedback?

The first step is to list down all the marginal probabilities as given in the background.

| Pilot | Outcome | Total | |

| Positive | Negative | ||

| Huge Success | 0.10 | ||

| Moderate | 0.15 | ||

| Break Even | 0.50 | ||

| Loser | 0.25 | ||

| Total | 1.0 |

The next step is to estimate the joint probabilities of pilot success in each category.

95% of blockbusters get positive feedback = 0.95 x 0.1 = 0.095.

Let’s fill the respective cells with joint probabilities.

| Pilot | Outcome | Total | |

| Positive | Negative | ||

| Huge Success | 0.095 | 0.005 | 0.10 |

| Moderate | 0.105 | 0.045 | 0.15 |

| Break Even | 0.30 | 0.20 | 0.50 |

| Loser | 0.05 | 0.20 | 0.25 |

| Total | 0.55 | 0.45 | 1.0 |

The rest is straightforward.

The answer to the first question: the chance of positive feedback = sum of all probabilities under positive = 0.55 or 55%.

The second quesiton is P(success|positive) = 0.095/0.55 = 0.17 = 17%

| Pilot | Outcome | |

| P(Positive) | P(success|Positive) | |

| Huge Success | 0.095 | 0.17 |

| Moderate | 0.105 | 0.19 |

| Break Even | 0.30 | 0.55 |

| Loser | 0.05 | 0.09 |

| Total | 0.55 | 1.0 |

Reference

Basic probability: zedstatistics