Chain Store Paradox – The Game

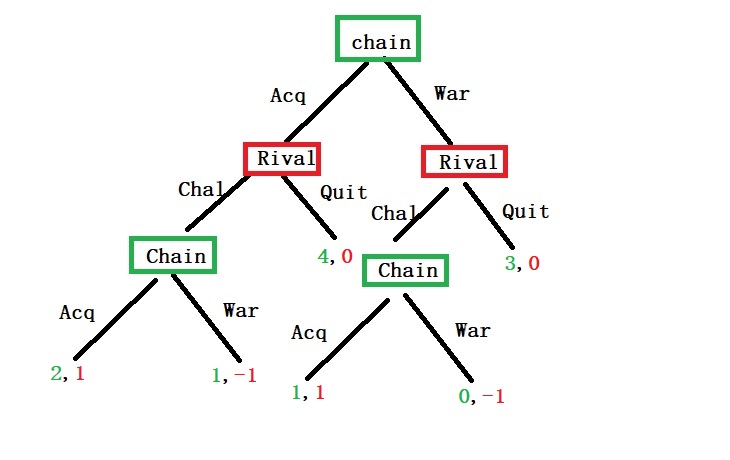

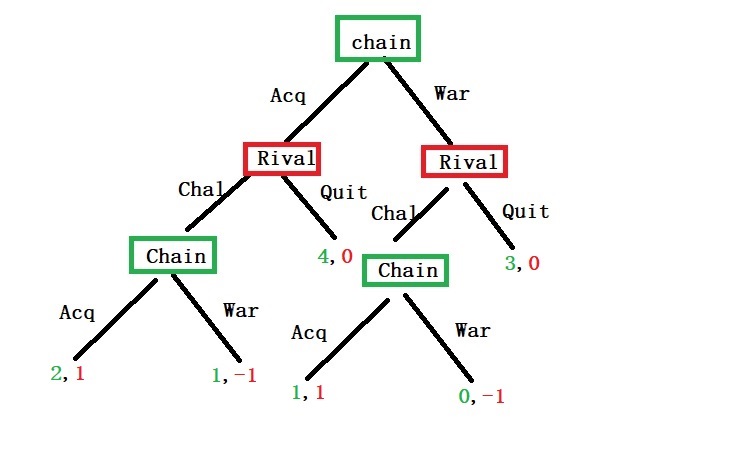

A chain store is challenged in town 1 by a rival. The store has two options – to go for a price war or acquiesce. In another town, town 2, another potential rival observes this and chooses to enter the market or quit. The chain store in Town 2 has to decide again whether to go for a price war or acquiesce with the new rival. Here are the payoffs:

The chain earns 0 when it goes to war

The chain earns 1 when it acquiesces

The chain earns 3 if the second rival quits

The second rival earns -1 from war

The second rival earns 0 from quitting

The second rival earns 1 from acquiesces

Note that rival 1 is already in town 1, and its payoff is irrelevant. Let’s draw the game tree and then solve the game using backward induction.

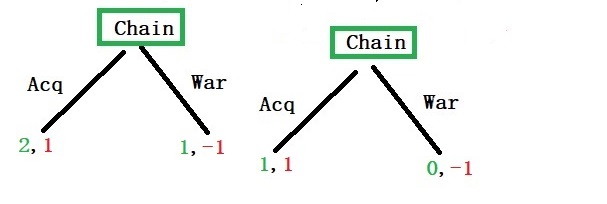

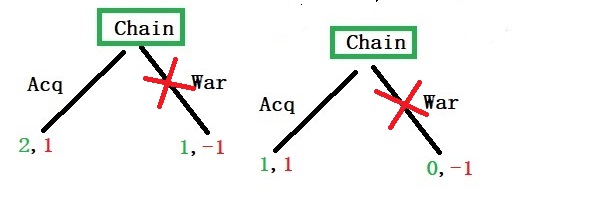

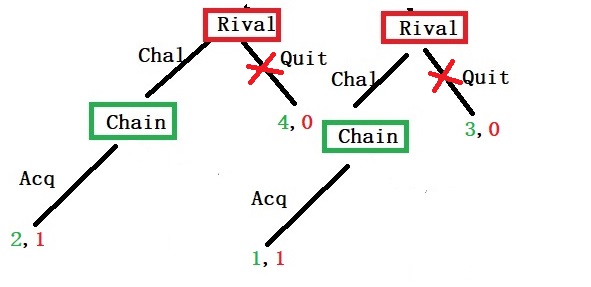

Step 1: payoffs at the lowest level

When the chain compares with the two options, acquiesce or war, it sees benefit for the former (2 > 1 and 1 > 0).

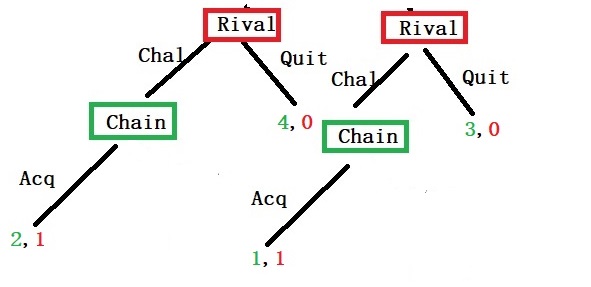

Step 2: One level up

The rival knows (based on the backward induction logic) that the chain will choose to acquiesce over war. It can now decide to quit or challenge. Clearly, the benefit is in challenging (1 > 0 and 1 >0).

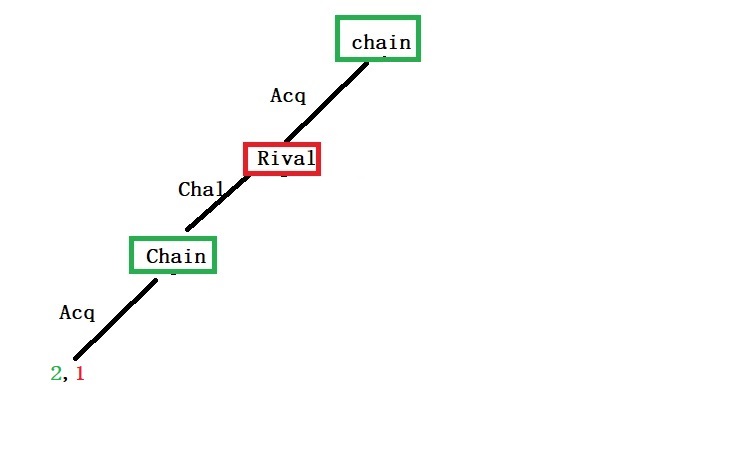

Step 3: Top level

Extending the logic, one can expect the choice for the chain is to acquiesce over war. Therefore, in the following equilibrium, the chain store acquiesces, and the rival enters the market.

So, what is the paradox?

Chain Store Paradox – The Game Read More »