Is international trade Pareto efficient? To understand that, we will create a scenario for the trade of a commodity from country A to country B.

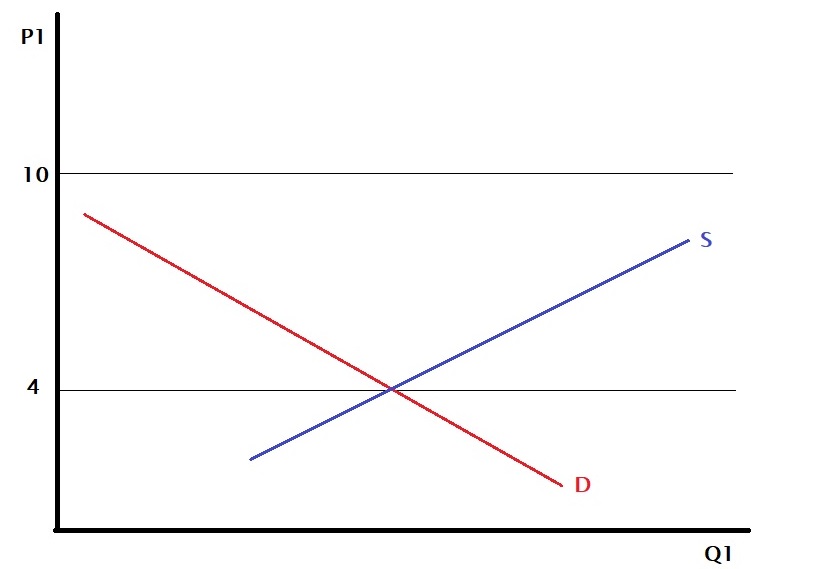

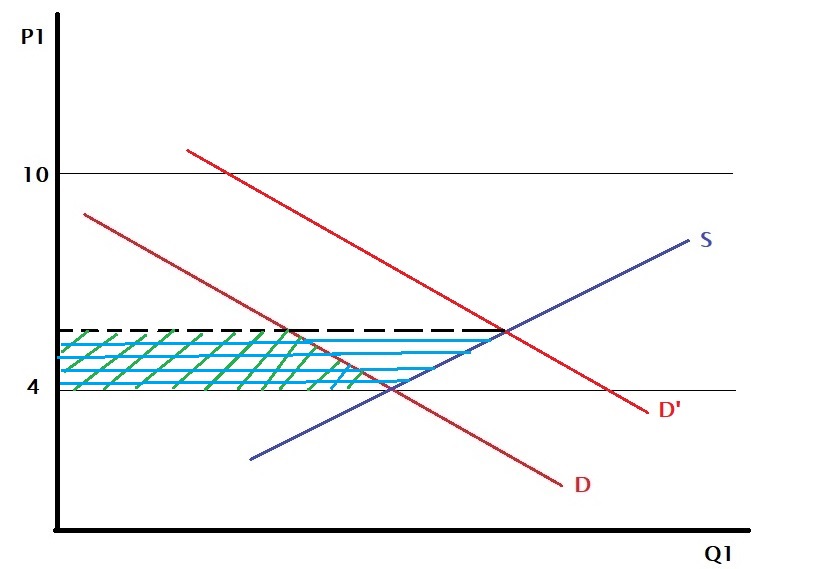

Country A

Before exporting started, $4 was the price of the commodity based on the supply and demand curves.

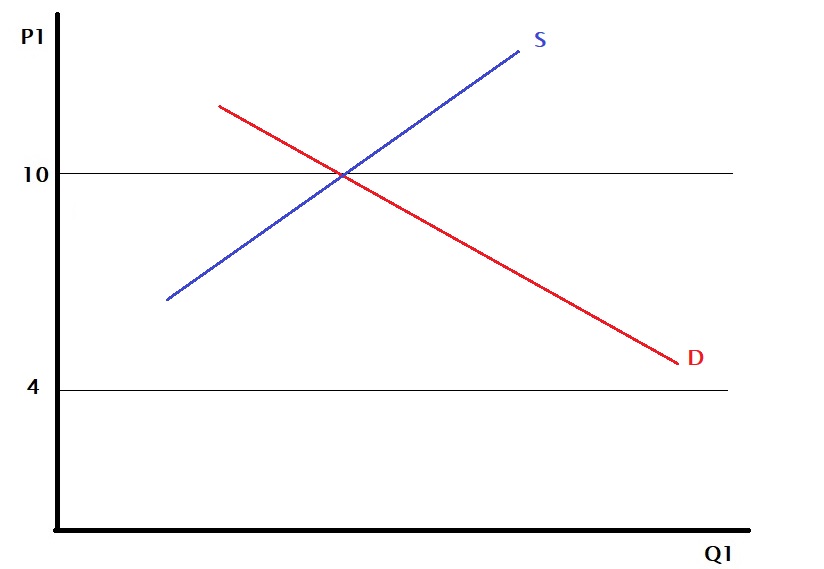

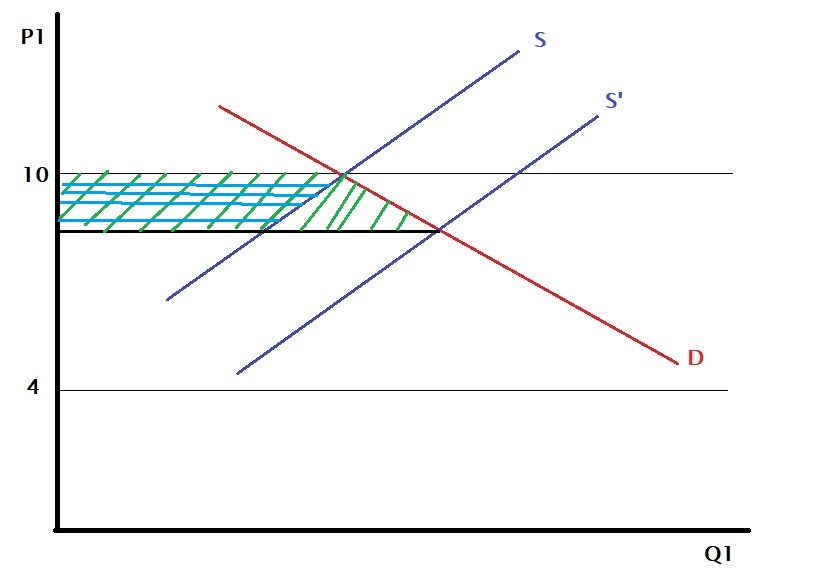

Country B

At the same time, the price of the same item in country B was $10.

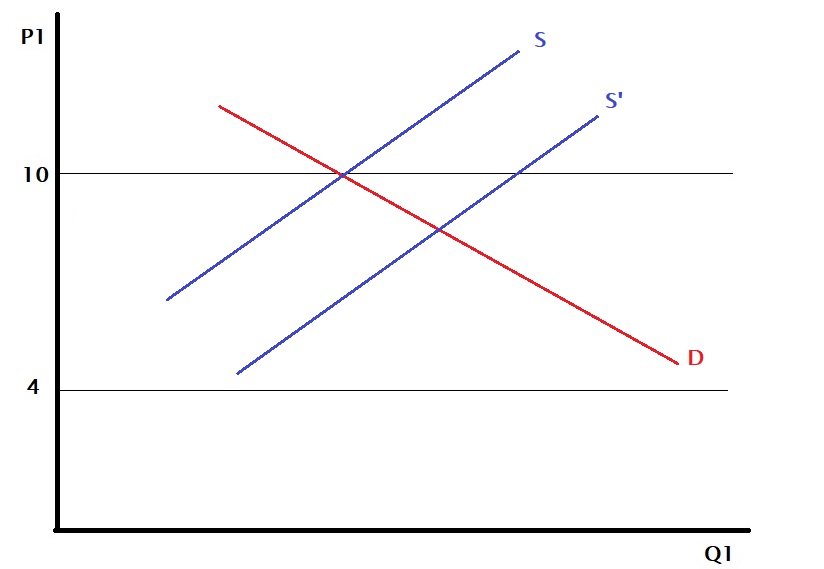

When country A exports goods to country B, the supply curve of the latter shifts by that amount to the right (to higher Q).

So the price in country B has reduced from $10 to $8.

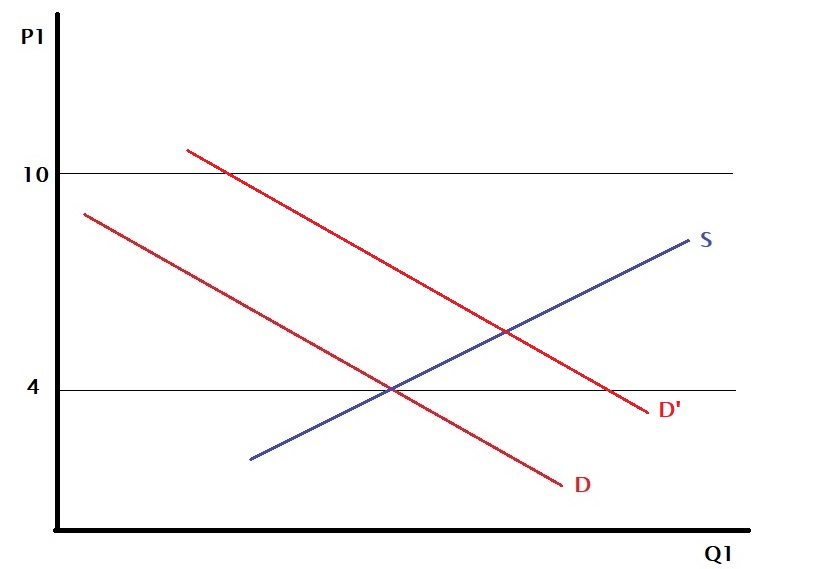

At the same time, you may imagine that the demand curve in country A shifts to the right (towards higher Q) because by adding the new entity (country B) to the existing domestic demand, country A has increased the demand.

And the impact is? The price in country A has gone up from $4 to $6.

Country A’s consumers are hurt because of the price rise, but the producers are happy as they can enjoy a higher price in the other country. On the other hand, consumers in country B are pleased because of the lowering, but their domestic producers are unhappy as this move impacted their margin.

In country A, the consumers lost the area shaded in green (the area under the demand curve between the two prices). At the same time, the producers gained the region corresponding to the blue-shaded (the one above the supply curve between those two prices). And the net benefit is the blue-shaded triangle (blue-shaded – green-shaded). So the is a net benefit for country A.

On the other hand, in country B, the consumer gained the larger area (green), whereas the domestic producers lost the smaller (blue), and the net is a gain – the triangle that has only green shade. So a net benefit here as well.

Pareto efficiency

So the trade yielded net benefit for both countries. But was the move a Pareto improvement? It was not; because, in the process of trade, the consumers in country A are worse off, and so are the domestic producers of country B.