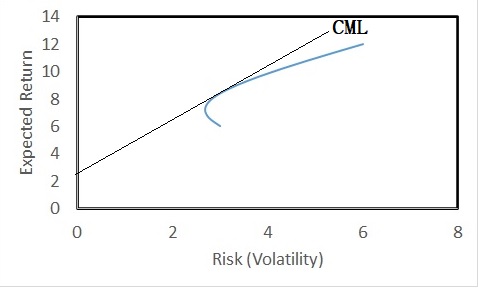

The relationship between risk and rewards, that reward increases with risk, is much engrossed in common knowledge. In investing, we have seen portfolio theory and capital market lines that confirm this notion.

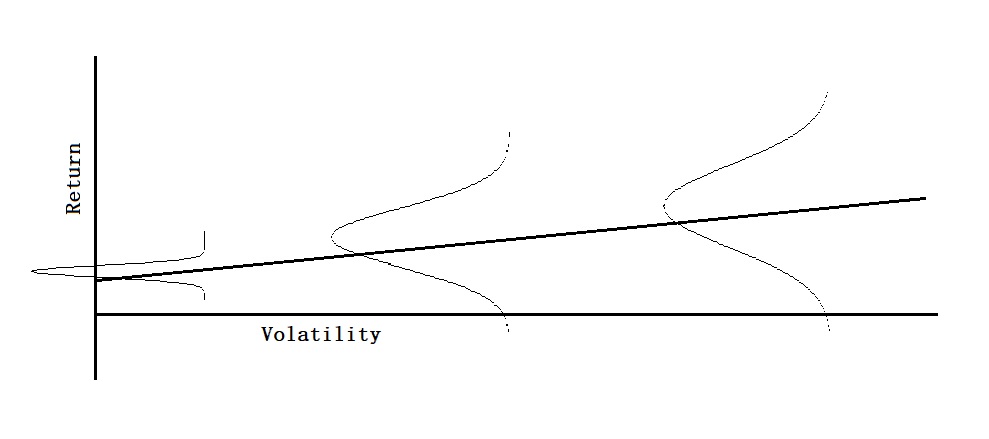

But the risk-return line is far from straight. We have seen earlier that the X-axis (risk) in the case of an investment is the volatility of the portfolio. In the language of statistics, volatility is the standard deviation of the distribution. In other words, each point of the line represents a distribution (of returns), with higher and higher standard deviations from left to right.

While the expected returns, the mean of the distribution, are higher to the right, the chances of higher and lower returns (including losses) are also higher. The critical issue here is that no one knows the breadth of the distribution or its shape. Imagine if it is what Nassim Taleb calls a fat tail, an asymmetric distribution, or the occurrence of a heavy impact-low probability event.

Reference

Howard Mark’s Memo on Risk