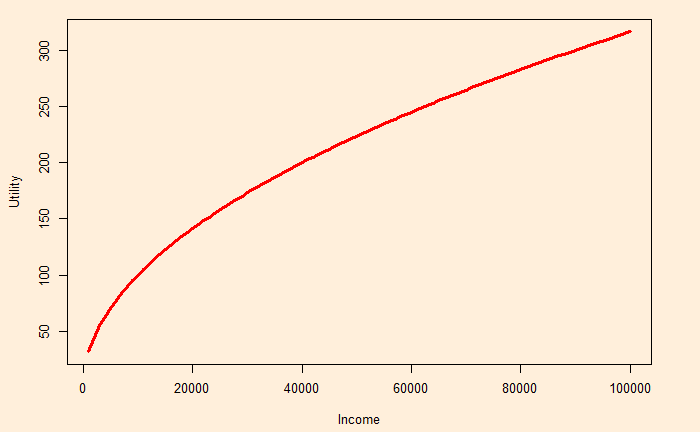

We have seen what expected utility is and how it’s different from the expected value. Suppose Amanda earns 100,000 dollars a year and has a 1% chance of getting sick. The cost of sickness is 50,000 dollars (on medical bills). Amanda’s utility function is:

U = I1/2; where I is the income.

What is her maximum willingness to pay for insurance that covers 50,000 dollars in medical bills?

The maximum willingness to pay is the price, at which she is indifferent between buying the insurance and not. Therefore,

Expected utility with insurance = Expected utility without insurance.

(100,000 – P)1/2 = 0.99 x (100,000)1/2 + 0.01 x (100,000 – 50,000)1/2

P = 100,000 – [(0.99 x (100,000)1/2 + 0.01 x (100,000 – 50,000)1/2)]2

P = $585