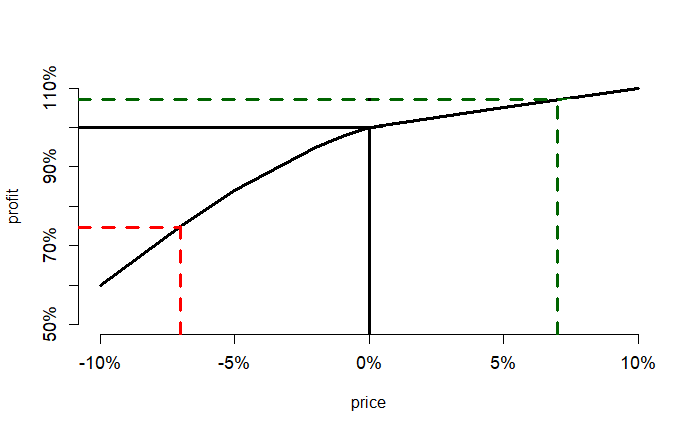

Let’s apply Jensen’s Inequality to the housing market. It concerns default rates on housing loans with the housing prices. When the housing prices are high, the defaults reduce; when the prices are lower, defaults increase but not in the same magnitude. Here is a fictitious plot of % of bank profit vs % change in housing price.

A 7% increase in house price increases the bank’s profit by about 7%, whereas an equivalent decrease in price leads to about a 25% drop in profit!