Here are my two pennies’ worth for the new year

Start early and stay invested for long

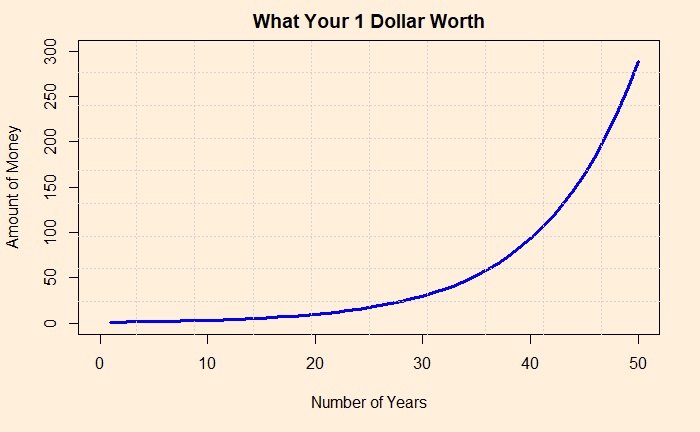

The rule of compounding is in the following manner. Your money is on the y-axis, and the number of years you have invested in is on the X. Here, you invested 1 dollar and fetched average yearly returns of 12%.

Read the conditions

Each number is important. Read the conditions regarding the fees to enter and exit a scheme. Do you want to know the price you pay for not doing it? Read the next section.

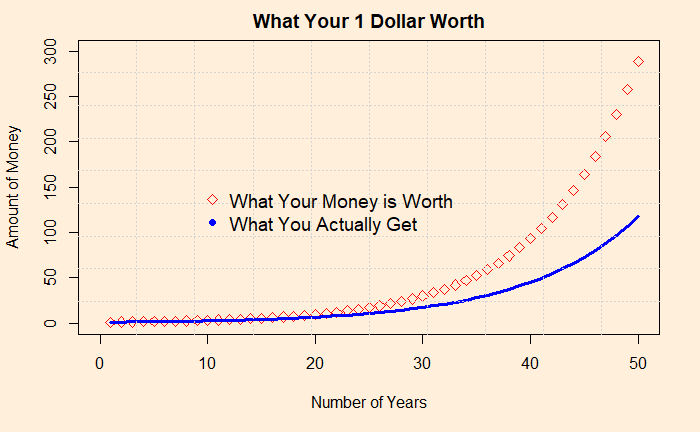

If you allow 2% to go, you lose 60%

You have a product that can give a 12% annual return from two sources: 1) takes no expense ratio and 2) takes a 2% expense ratio. Take the one with no expense ratio. In India, this means buying direct mutual funds and not regular ones. Look what happens to an investment worth 12% (red diamonds) and the one with 2% subtracted.

Trust the plots above

or remember the formula of compounding

![]()

Most financial advisors are just agents

who have conflicts of interest.

In summary, do the scheme of your choice, not the agent’s. Remember the rule of compounding.