We have seen that the free market is at a Pareto efficient state, and therefore, it will not care about shouldering the social cost of carbon. The only way to break this equilibrium is through regulatory intervention. And the two popular mechanisms are carbon tax and cap and trade. The intention is to force firms to alter the production process to reduce emissions per unit of goods sold in the market.

Carbon tax

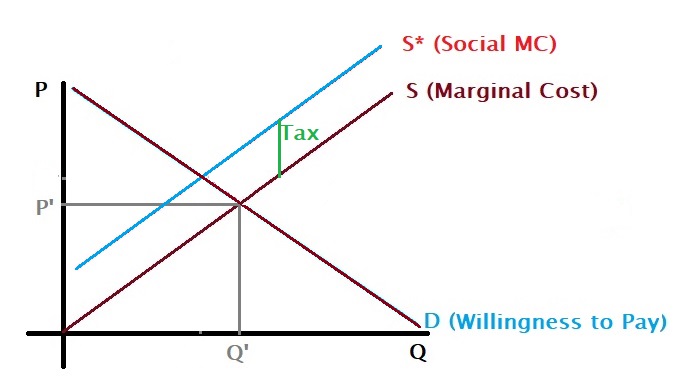

It works if you know the price of unit emission of CO2 to the atmosphere. In other words, you know the social cost of carbon and set a tax on the difference between the supply marginal cost curve and the social cost curve.

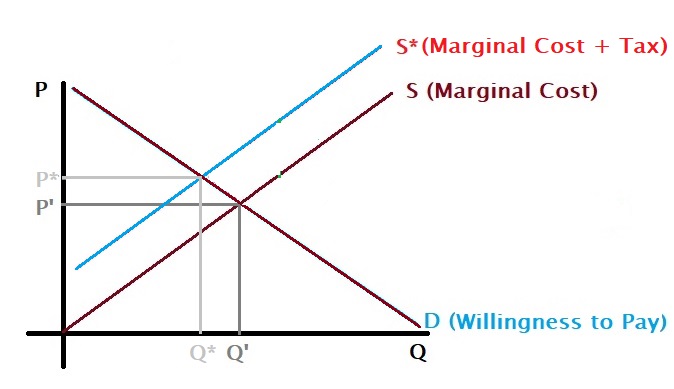

Subsequently, the price moves up to P, and consumers’ willingness to pay moves towards reduced consumption, Q.

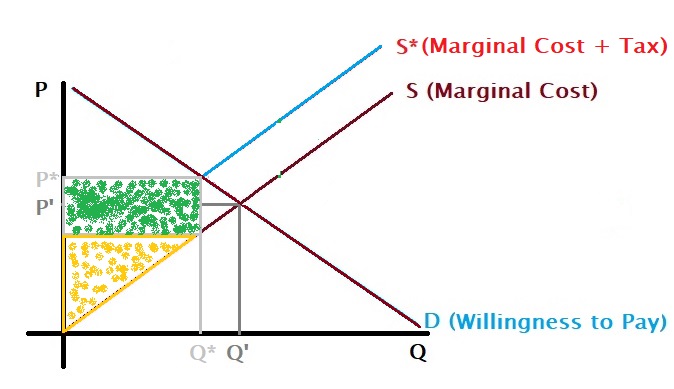

In the process, the regulator gets a revenue (green box), the firm’s profit (yellow triangle) reduces a bit, and the consumer ends up paying more!

The regulator will use the money for handing over incentives to reduce CO2; the firms will also find low carbon innovations to bring back their margin and also sell more products to satisfy the needs of the customer.