In the previous post, we have seen how banks can lose money when they do the business of making money by disbursing loans. This time we will see how banks manage that risk by setting an interest rate for every loan they give. It means every lender needs to pay a fixed proportion of the borrowed money to the bank as a fee.

How does a bank set an internet rate? It is a balance between two opposing forces. If the rate is too low, it will not adequately cover the risk of defaults, and if it is too high, it could keep the customers away from taking loans.

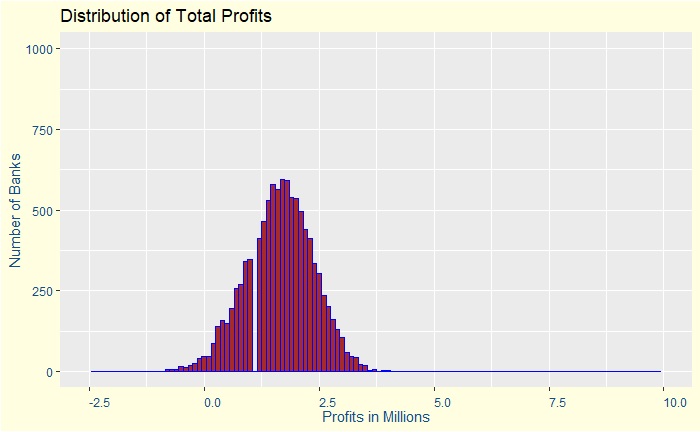

Take the case of 10,000 banks each lends 90,000 dollars per customer to 2000 customers. Let’s say the bank sets an interest rate of 3% on the loans. After running Monte Carlo simulations, we can see the following.

The bank can earn a net profit of about 0.26 mln, but there is a 35% that it will lose money. In other words, 3500 banks won’t make money. The plot below describes this scenario.

Increase the interest rate to 3.8%. The expected profit is 1.6 mln, and there is about 1% of losing money. That sounds reasonable for a person to run the business. See below for the distribution.

Increase the interest rate to 5% and the profit if we manage to have all the customers intact is 3.77 mln and almost 0% chance of losing money. But a higher interest rate can drive customers away from this bank. Suppose three fourth of the customers have gone to other banks. The profit from 500 customers is less than a million and also there about 0.8% of losing money. Note that fluctuations increase to our estimations – net profits and the chances of making money – as the numbers are smaller (the opposite of the law of large numbers).