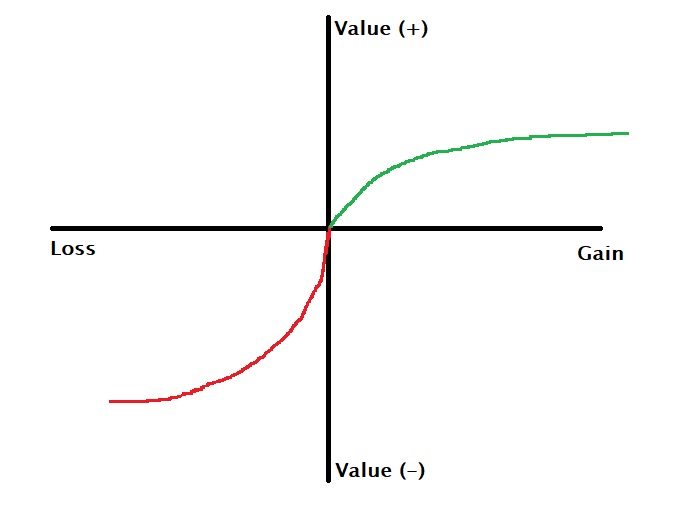

Prospect theory is a behavioural model which explains how people make decisions that involve risk. It has been observed that people take gains and losses differently. In short, to the decision maker, the pain of losing something scores higher over the pleasure of gaining – the risk aversion.

The plot below illustrates the prospect theory. While both the positive side (green part) and the negative side (red part) reflect diminishing marginal utility (flattening towards the higher x values), the initial few gains and losses have distinct shapes. Imagine the feeling you have when you get 100 dollars; compare that with gaining an additional hundred dollars, say from 2000 to 2100.

The fundamental question here is: what defines the origin of the plot? One possibility is that it represents the present state. I can also argue it marks the expectations. An example of the latter is the famous case of silver medal winners. Studies seem to indicate that the second-place winners of sports events were unhappier than the third-place holders, especially when it is contrary to prior expectations.

Daniel Kahneman and Amos Tversky; Econometrica, 47(2), 1979, 263-291

McGraw et al.; Journal of Experimental Social Psychology 41, 2005, 438–446