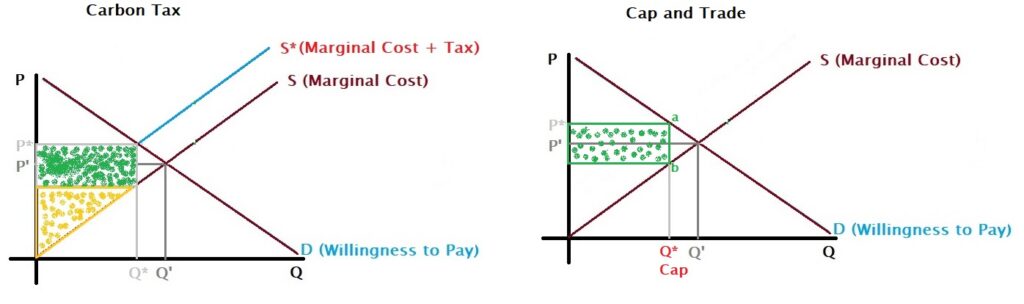

We have seen already – the carbon tax sets a price for CO2 release but is uncertain over the total emissions. Cap and trade define total emissions, not the price (the social cost of carbon). Yet, in an ideal market, both yield similar outcomes.

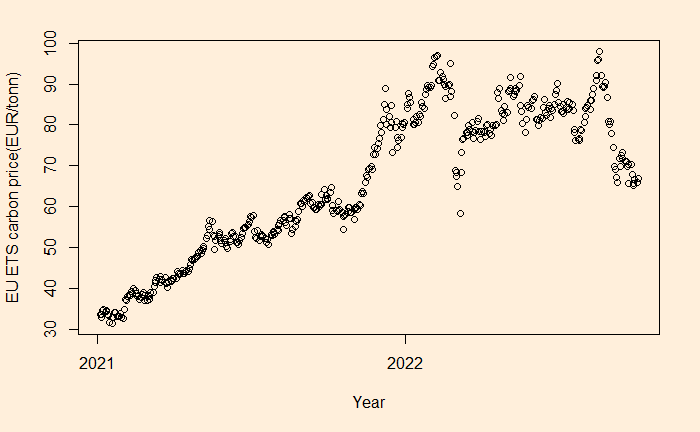

There are differences, though. Tax prevents emissions price volatility. Here is an example of price fluctuations in the market. It may prompt you to argue for a price floor, price ceiling or both.

A common criticism against the cap and trade system notes the requirement of additional administration fees. They argue that the carbon tax scheme applies at the point of origin of carbon (upstream), where the number of players is in the thousands. Whereas the cap and trade method is at the point of burning (downstream) where the numbers are in millions. Experts dismiss this argument and point out the applicability of both schemes on either end. It is, however, a fact that, unlike that in the carbon tax, in cap and trade, the regulator not just watches the emissions but also monitors the transactions of permits between companies.

Another concern that a tax-based system often underestimate is the physics of emissions, i.e. the nonlinearity of climate calamity with CO2 in the atmosphere. A fixed (or even a variable) carbon tax lets the emissions go on a free ride, whereas the cap and trade fix the total emissions, no matter what.

The final difference is how the two schemes sound different. In countries where the word tax is synonym with encroachment on personal freedom, cap and trade is a politically acceptable solution to climate change.

References

NBER Working Paper Series: Goulder and Schein

EU Carbon Price Tracker: EMBER